Common Questions

Here are answers to questions we are frequently asked.

Payments & Billing Questions

When is my bill due?

Your bill is due on the date indicated in the top right corner of your Billing Notice, or in the Bill Amount Due line in your E-Bill notification. Due dates are always on a business day, meaning no NCFB holidays or weekend dates. If you think you may have trouble making a payment on time, please contact NCFB Customer Service at (919) 782-1705 to discuss payment options.

Can I pick the date that my payment is due?

No; this feature is unavailable at this time.

What payment options (method of payment and payment plans) do you offer?

Payment Types

NC Farm Bureau Insurance accepts the following forms of payments:

Cash

All credit and debit card payments will incur a 3% processing fee with the Visa, MasterCard, Discover, or American Express logo

Personal check, certified check, or guaranteed check

E-check (online or by telephone only)

Money order

Payment Options

Policyholders may remit payments in the following ways:

In your local NC Farm Bureau Insurance office: Cash, check, money order, credit card or check card with the Visa, MasterCard, Discover, or American Express logo

Through the mail: Check

Via the ncfbins.com website: Click Payments & Billing. No log in is required to make a payment by electronic check or credit card. If you log into your NCFB Customer Portal Account, you can schedule a one-time payment, or you can set up automatic payments using a bank account or credit card.

Payments can be made over the phone at 1-866-483-1171 using a credit/check card or by entering your checking account information.

Payment Plans

Six Month Policies

12 Month Policies

Percentage of Premium

Per Installment

Full Pay

Full Pay

100%

Two Installments

Two Installments

50%

Three Installments

Three Installments

33.334% first

33.333% thereafter

Payment Plans

—

Four Installments

25%

*Six Installments

(Monthly)

Six Installments

16.667% first

16.666% thereafter

—

*Twelve Installments

(Monthly)

8.334% first

8.333% thereafter

*IMPORTANT: Monthly payment plan options are only available for eligible policies that are also set up on Electronic Billing (E-Bill) or Electronic Funds Transfer (automatic bank draft). Due to fluctuations in the amount due, EFT is not available for auditable policies.

Service Charges

With the exception of Workers Compensation policies, a $3.00 service charge is added to each installment as it is billed.

Changing Payment Plans

A policyholder may change their payment plan anytime during the policy term as long as the number of installments increases (e.g. from three installments to six installments).

The insured may delete, decrease, or increase the number of installments to take effect at the next renewal.

NOTE: The policyholder will receive a billing notice when a payment plan has changed, regardless of whether premium is due.

How can I set up my policy on a monthly payment plan?

Either Electronic Funds Transfer (automatic bank draft), or Electronic Billing (E-Bill) is required to be eligible for the monthly payment plan option.

To set up EFT, you will need to complete paper work at your local NC Farm Bureau office. Request your payment plan change at the same time.

If you are an existing customer and are interested in E-Bill, you can set this up yourself via the NCFB Customer Portal. After you have established E-Bill for your policy, contact your local NC Farm Bureau office to request the payment plan change. Please don’t forget this important second step. Requests for the monthly payment plan will not be processed if the policy is not set up on E-Bill.

If you are a new customer, please request the monthly payment plan when you meet with your agent to take out your policy. When it is issued, your policy will be set up to bill on a monthly basis. As soon as you receive your policy documents, set up an account on the NCFB Customer Portal and enroll your policy in E-Bill. If the policy is not enrolled in E-Bill during the initial policy term, when the policy renews, the monthly payment plan will be discontinued, and the policy will be placed on the next available payment plan.

Can I make a partial payment?

NCFB does not accept partial payments. Contact NCFB Customer Service at (919) 782-1705 to discuss payment options.

Why does my bill notice show a $0 amount due and no due date? If I don't owe anything, why am I getting a bill?

In addition to when premium payments are due, a Billing Notice is sent when a new business policy is issued, following the reinstatement of a policy, and when a payment plan is changed. The Billing Notice is sent to advise the policyholder of their account status so there may be no amount due, or if the amount due is less than $10, then that amount will be added to the next bill.

I’m currently enrolled in EFT. If I make a payment at an office or online, will my EFT payment still draft?

It depends on the timing. The alternate payment must be made by 6 PM at least two business days prior to the draft date to halt the scheduled EFT draft. If you wish to stop an upcoming EFT draft, call NCFB Customer Service at (919) 782-1705 as soon as possible for assistance and to discuss other payment options, if needed.

Why is my bill higher this month?

A change (such as adding a driver or automobile, or adding additional coverage to a policy) may have been processed that increased the amount of premium you owe. If your policy is on a payment plan, the increase may be spread over the remaining installments. Contact your local NC Farm Bureau office with questions regarding changes to your policy.

E-Bill Questions

I'm receiving paper bills - how do I sign up for paperless bills?

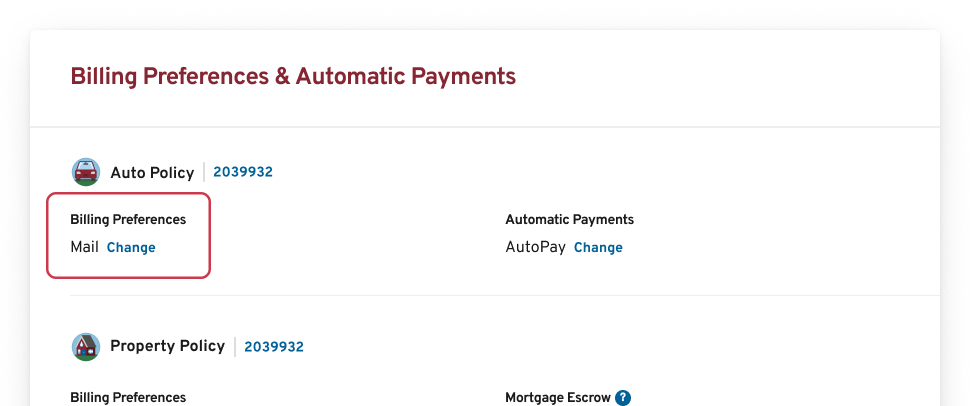

Click the "Change" link under Billing Preferences in the Bill Preferences & Automatic Payments section of the Billing page. You must accept the terms and conditions before enrolling in E-Bill. You must enroll each policy in E-Bill separately. Upon enrollment, you will receive an e-mail when you have a new bill and you will no longer receive a paper copy of your Bill Notice.

I signed up for E-Bill; why do I keep getting insurance documents in the mail?

While paper bills are no longer sent to policyholders who sign up for E-Bill, policy documents such as declarations, cancellation and expiration notices, will still be mailed to your physical billing address. Some of these notices, such as the cancellation and expiration notices, are required to be sent by law.

I signed up for E-Bill; why don’t I have the monthly payment plan?

Any policy on any payment plan can be on E-Bill. The request for a monthly payment plan is two-fold: First, you must register your policy or policies on the NCFB Customer Portal, then your agent, or another staff member in your local NC Farm Bureau office must submit your payment plan request. Both steps are required.

NOTE: If you purchase a new policy with us, you will need to wait until you receive your policy documents in the mail before registering for the Customer Portal. Your declaration and Billing Notice will have the policy number you need to register and enroll in E-Bill.

If you request the monthly payment plan at new business and the policy is not enrolled in E-Bill during the initial policy term, when the policy renews, the monthly payment plan will be discontinued and the policy will be placed on the next available payment plan.

Online Payment Questions

Is my information secure when making a payment?

Yes, please see our Privacy Statement for details regarding the efforts that North Carolina Farm Bureau makes to secure your personal information.

What is the difference between a Billing Notice and Policy Declarations?

A billing notice is a statement of the amount that you owe to NC Farm Bureau Insurance Group for charges related to your insurance coverage. A policy declarations page is part of the insurance policy that provides detailed information such as the insured name, description, location and property covered.

How do I find my Billing Notice on the Customer Portal to pay my bill?

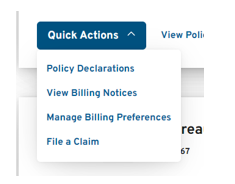

After logging into your Customer Portal account, you can select the View Billing Notices Link in the Quick Actions drop down for the applicable policy. You can also click the View Billing Notices link in the Billing Status section of the Billing page.

Do you send payment reminders?

Policyholders registered to use the NC Farm Bureau Insurance Customer Portal and enrolled in E-Bill are sent a reminder email five days prior to their billing notice due date if the bill has not yet been paid.

Are my payments guaranteed?

Yes. You can be assured that your electronic payments are safe and reliable. Your payments are protected in the unlikely event of unauthorized transactions or processing delays.

Claims Questions

How do I report a claim?

To report a claim, contact your Agent. Have your policy number or policy declaration handy so that your Agent may review the coverages you have as it relates to the claim that you wish to file. Be prepared to provide detailed information regarding your property damage or loss. Click here to find your Agent.

If you need to report an auto window or windshield claim, call our toll-free glass line at (800) 555-3276, to schedule a repair. Our representatives are available 24 hours a day, 7 days a week.

North Carolina Farm Bureau policyholders may file an Auto, Towing & Labor or Property claim online by visiting our Claims page and either clicking ‘Log In’ if they have a Customer Portal account, or by clicking ‘File Without Logging In’ if they do not have a registered account.

Not a NC Farm Bureau Insurance customer but need to report an auto accident that occurred with one of our policyholders? Visit the Claims page and click the ‘File a Claim Online’ button in the ‘Not a North Carolina Farm Bureau customer’ section of the page. To report a Liability claim against one of our policyholders, contact the local NC Farm Bureau office in your community. Click here to find an office.

How can I check the status of my claim?

If you have filed a claim via the NCFB website and you have a Customer Portal account, you can view the status of your claim online. For more detailed information, and for those without a Customer Portal account, contact your claims adjuster for an update. If you are unable to reach him or her, contact your agent.

Automobile Claim Questions

I was in an auto accident with another vehicle. What should I do?

Do not admit fault.

Contact the police; especially if injuries have occurred.

Obtain the other driver’s name, address, phone number, license plate number, Driver License number and insurance information.

If there are witnesses, and/or occupants of the other vehicle(s) involved, try to get their name and contact information, as well.

Take detailed pictures of the damage and scene of the accident.

Jot down relevant details while they are fresh in your memory. For example: note the direction that you were travelling, speed, and lane of each vehicle, etc.

Report your claim as soon as possible by calling your local Farm Bureau office, entering it via the Claims tab on this website, or by using the NCFB mobile app. If the other driver is at fault, contact their insurance company to file a claim with that company as well.

A claims adjuster will contact you as soon as possible and will provide you with additional information regarding the claims process.

My car was stolen, what should I do?

If your vehicle has been stolen, contact the police immediately and file a police report.

If your vehicle is leased or financed, also contact the lender or leasing company.

Report your claim as soon as possible by calling your local NC Farm Bureau Insurance office, entering it via the Claims tab on this website, or by using the NCFBINS mobile app.

Renting a vehicle: policyholders with “Other Than Collision” coverage on their personal auto policy have limited coverage for vehicle rental expenses when a covered vehicle is stolen. Policyholders with Extended Transportation Expenses Coverage may also be reimbursed for rental expenses. Review your policy declaration or contact your agent to verify whether you have either of these coverages. There is a 48 hour waiting period for the rental.

A claims adjuster will contact you as soon as possible and will provide you with additional information regarding the claims process.

My vehicle is drivable. Should I get some repair estimates?

Your claims adjuster can advise if estimates are necessary. We may be able to prepare an estimate and work directly with the repair shop of your choice.

Can I get a rental car following an auto accident?

NC Farm Bureau Insurance policyholders with Extended Transportation Expenses Coverage may be reimbursed for rental car expenses when a covered auto becomes non-drivable. This coverage applies if the vehicle is inoperative for at least 24 hours. If you are unsure whether you have this coverage, contact your agent or associate agent.

If you were not at fault in the accident, contact the other driver’s insurance company for assistance securing a rental vehicle.

While you may choose any rental car company, NC Farm Bureau Insurance customers often rent vehicles from Enterprise (1-800-736-8222 or www.enterprise.com), or Hertz (1-800-582-7499 or www.rent-cars.com).

When you rent the vehicle, let them know that an insurance claim is being filed so that you may be charged the appropriate rate.

If you rent a vehicle before speaking to a claims adjuster, please let the adjuster know once you have been contacted.

Do I need to use a body shop associated with NC Farm Bureau?

No. NC Farm Bureau does not require the use of specific body shops.

What if the other driver was at fault but their insurance company is taking too long? Can I file my claim through NC Farm Bureau?

Yes. If you have collision coverage, you can file the claim under your own policy with NC Farm Bureau. The claim will be subject to your collision deductible. We will attempt to collect the damages from the at-fault party’s insurance company. If we are successful, your deductible will be reimbursed.

Property Claim Questions

Can I complete temporary repairs without approval from a claims adjuster?

Yes. Your policy requires that you take all necessary steps to protect your property from further damage. Be sure to save receipts for all repairs and give them to your claims adjuster. Take pictures of the damage if it is safe to do so.

Can I remove a fallen tree from a damaged structure without prior approval from an agent or claims adjuster?

Yes. If your home is damaged by a covered and payable loss described in your policy, the policy will pay to remove the tree off the structure and to the ground. Some policies may pay a maximum amount for all trees to be removed from the property of $500. Trees that do not damage covered property, such as leaning tree not touching a building, would not be covered for removal under the policy.

Can I discard damaged or destroyed personal property prior to being inspected by a claims adjuster?

No. Even if belongings appear to be a ‘total loss,’ do not discard them until they have been examined by an adjuster. Prepare a detailed inventory of all damaged or destroyed property and keep a copy of this list for your records. The list should include a description and picture of each item; the quantity of like items if more than one; the place and date of purchase or the approximate age of the item; the cost of the item at the time of purchase; and the estimated replacement cost.

Is there a limit on the amount you will allow on certain repair costs?

Your policy will pay for reasonable and customary costs of repairs to covered property in your area.

Should I obtain a repair estimate prior to a claims adjuster inspecting my property?

If you feel it is necessary, secure a detailed estimate for permanent repairs from a reliable contractor and give it to the adjuster when he or she arrives. Minor repair estimates should be sent to your agent as they may not require an on-site inspection by a claims adjuster. The estimate should contain detailed specifications of the proposed repairs and the associated cost. You should provide detailed photos of the damage along with the estimate.

Does my policy cover food spoilage resulting from a power outage?

Limited coverage for food spoilage may be available under homeowners and farmowners policies that have the “Refrigerated Property Coverage endorsement.” This endorsement carries a separate deductible. If you experience a refrigerated property loss, make a list of all items and take photos prior to disposing of the items. Contact your agent for more information about this coverage.

Will I be reimbursed for additional living expenses if my home is unlivable?

Yes. If your home is damaged by an event specified in your insurance policy and your home becomes unlivable as a result, you will be compensated for reasonable expenses above your normal living costs while you are away from your home during a reasonable duration of repair. Examples of expenses incurred during this time include but are not limited to housing, meals, and storage. Please note that the loss of electricity and/or water does not qualify your home as unlivable.

How will my policy deductible be applied?

The policy deductible is subtracted from the total cost of covered damages. The balance is subject to any coverage limits outlined in your policy. A separate deductible often applies to specific endorsements such as the Refrigerated Property Coverage Endorsement and the Scheduled Personal Property Endorsement. Some policies have a separate deductible for windstorm/hail losses. For policies written through the North Carolina Insurance Underwriting Association (NCIUA), the windstorm/hail deductible is usually a percentage of the Coverage A limits. (Coverage A in your homeowners policy is for the dwelling.)

Glass Claim Questions

What should I do if windows are shattered in my car and it is after hours or over the weekend?

Secure the vehicle as best as you can to prevent further damage.

Report the claim to 1-800-555-FARM (3276) as soon as possible.

If you file a claim online after hours or over the weekend, a claims representative will still need to review your submission before it can be approved and processed.

If you choose to have repairs made prior to speaking with a representative, you will be reimbursed up to the amount normally paid through our agreements with local glass replacement companies. If you pay out of pocket but intend to submit an invoice for reimbursement, let the glass company know that you will be filing a reimbursement claim with NCFB. The shop may offer you our agreed pricing.

Will NCFB assist me with finding a glass replacement company in my area?

Yes, if you need assistance. We use a third party service that can assist you with finding and scheduling a shop to handle your glass repair or replacement.

Do glass replacement companies offer mobile service?

Most auto glass companies offer mobile repairs. The third party service that we work with can assist you with scheduling a mobile repair or replacement.

Can I take my car to a dealership for glass repair?

Yes. However, you may want to contact the dealership to see whether they do their own glass repair work. Many dealerships subcontract the work to a glass replacement company. If the dealership does not perform its own glass work, we would need to review an estimate. Not all dealerships honor our glass shop pricing and you would be responsible for any difference in price.

Do I need to use an auto glass service associated with NC Farm Bureau?

No. We work with providers across the state, but do not require the use of specific companies.

Is NCFB able to assist me with finding a glass replacement company in a state other than North Carolina?

Yes. We work with glass companies in all 50 states.

Are deductibles waived on glass replacement?

No. In North Carolina, glass replacement falls under Comprehensive Coverage. If there is a deductible on your Comprehensive Coverage, it will apply for a glass claim.

Does NC Farm Bureau waive the comprehensive deductible for chip repair?

Yes. However if the repair fails, or you decide later to have the windshield replaced, you will be responsible for the deductible at the time of the windshield replacement.

Towing & Labor Claim Questions

Do I have Towing and Labor Coverage on my auto policy?

Towing and Labor coverage is available at an additional cost as an endorsement on your personal or business auto policy. Review the current coverages listed on your policy’s declaration page and discuss with your agent or associate agent whether adding Towing and Labor coverage would be beneficial to you.

Does North Carolina Farm Bureau dispatch a tow truck when I have a towing claim?

No. NCFB does not have a Roadside Assistance Program. Towing claims under this coverage are by reimbursement only. You would need to arrange the tow and be reimbursed for it. Be sure to keep your receipt.

What information is needed to be reimbursed for towing and labor costs?

Please provide us with a legible copy of your paid invoice. This can be mailed, faxed to 919-647-4725, or emailed to towing.claims@ncfbins.com. Your agent or staff in your local office can also assist with sending this information to the Claims Department. Please include your policy and claim number on all correspondence.

How many tows will my policy cover per disablement?

The policy covers one tow per disablement.

If my policy indicates that I have “unlimited” towing, does that mean I can have my vehicle towed anywhere?

No. The policy states that "we will pay towing and labor costs incurred... for towing to the nearest place where necessary repairs can be made."

Would my coverage extend to a disabled trailer that was attached to my vehicle?

Yes. However, the payment is limited to the coverage limit you have selected.

Policy Questions

How can I change my name or address on my policy?

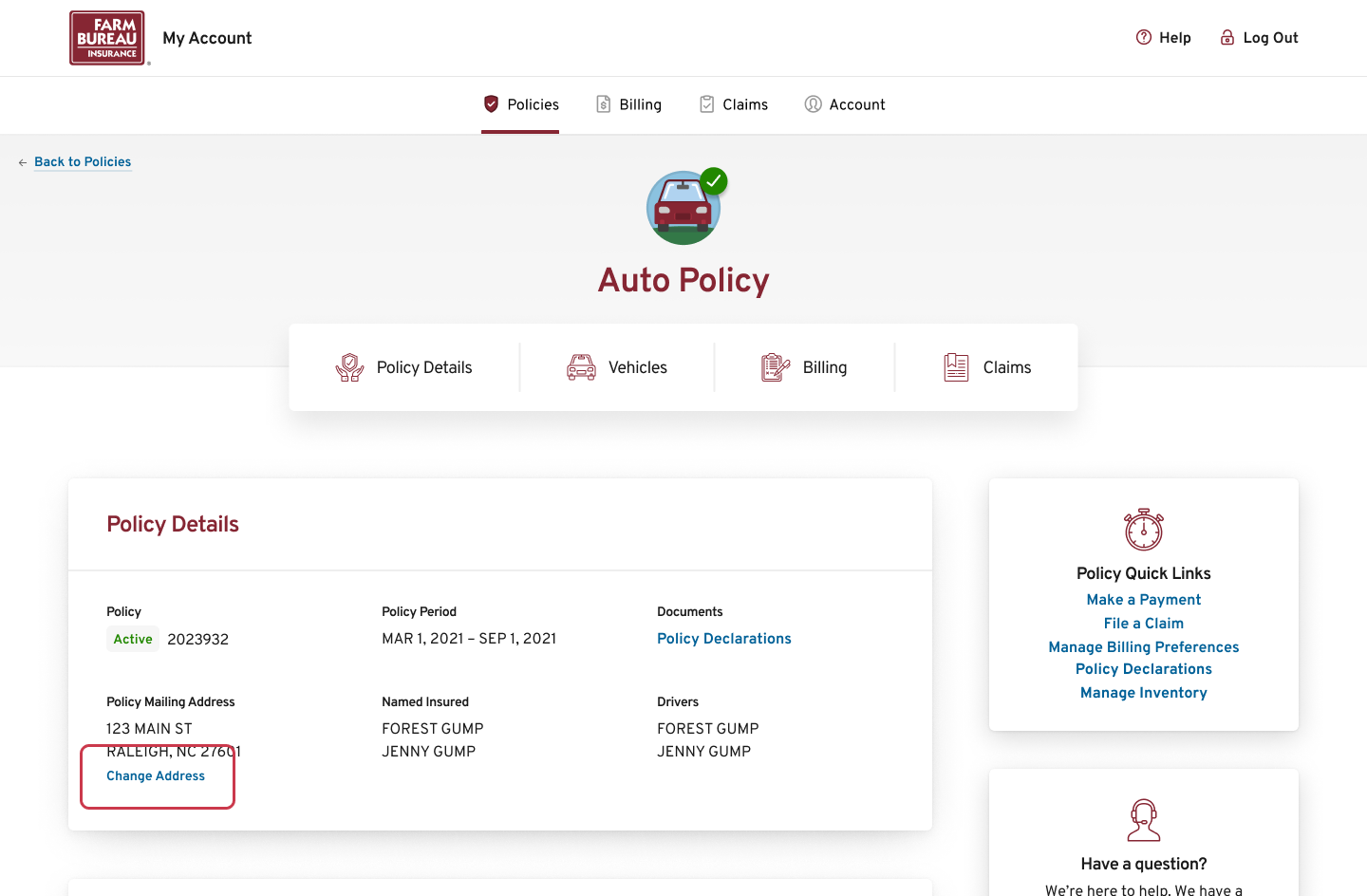

You can update your mailing address anytime online by clicking the "View Policy Details" link for the applicable policy.

Once you are on the Policy Details page, click the "Change Address" link below the Policy Mailing Address.

Once you update the address for the selected policy, you have the option to apply this mailing address update to your other registered NC Farm Bureau Insurance Group policies and your NC Farm Bureau membership.

Please contact your NC Farm Bureau agent to update addresses for policies written through our partners (life insurance, flood insurance, health insurance, NCJUA/IUA, etc.) or to request a name change.

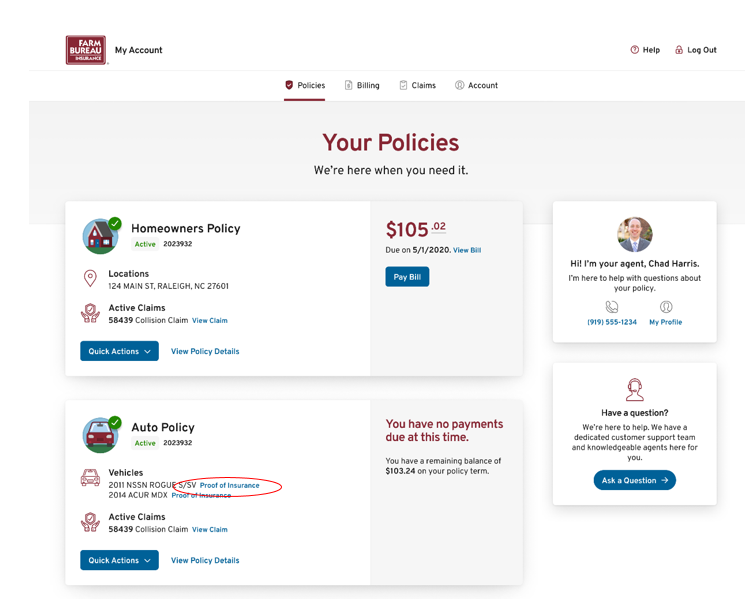

How do I view and print my automobile proof of insurance card?

To view and print your automobile Proof of Insurance Card on an active policy, click on the "Proof of Insurance" link beside the applicable vehicle on the Policies page.

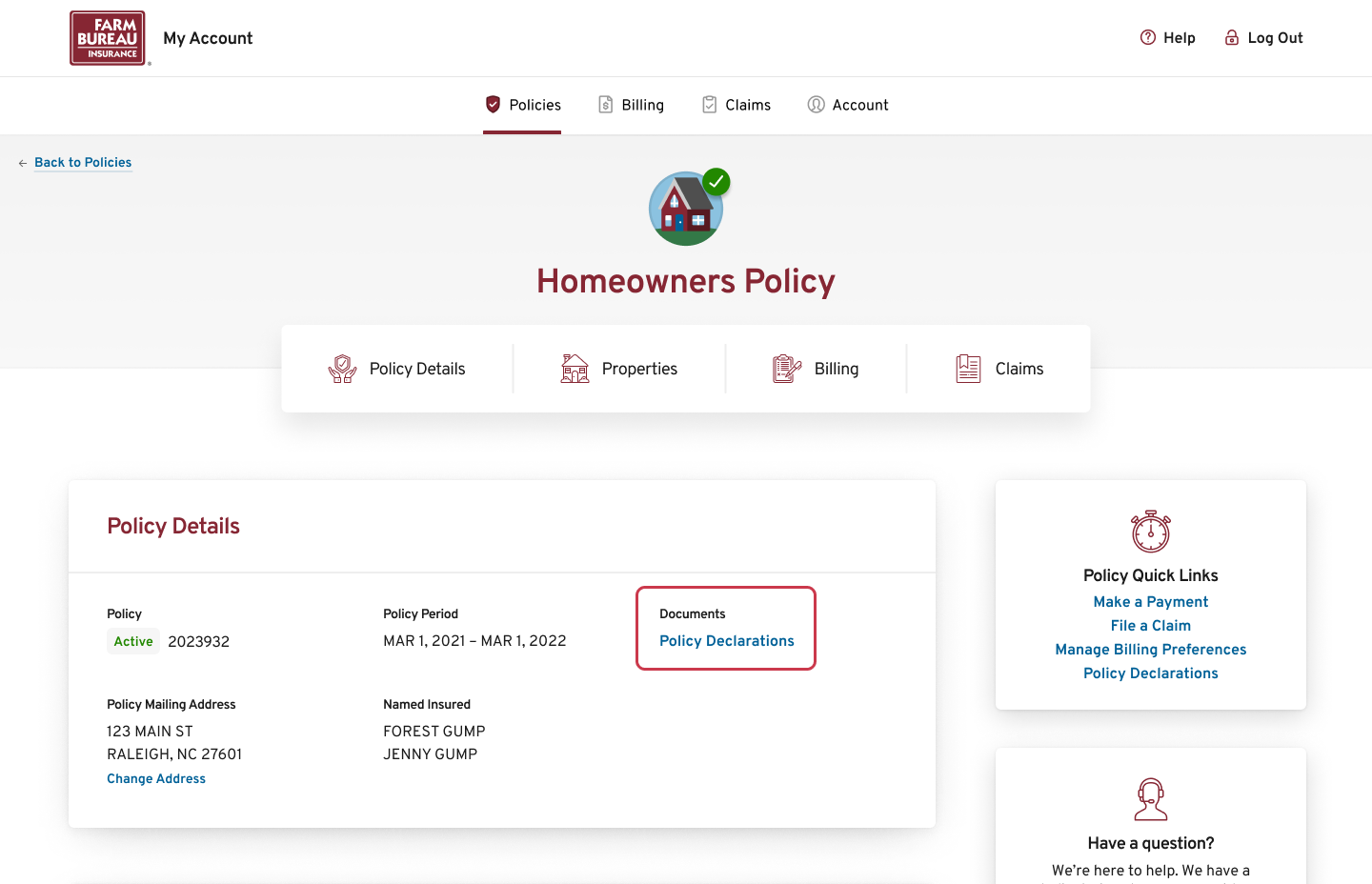

How do I view and print my declarations?

The Quick Actions feature on the Policy page will offer a link to your Policy Declarations for any policy where these are available.

You can also access your declarations from the Policy Detail page for each policy where declarations are available. The link for “Policy Declarations” is in the Documents section.

How can I make updates to my policy?

Contact your agent, associate agent, or other staff members in your local NC Farm Bureau office to request changes to your policy. (i.e., adding or removing drivers, vehicles, or coverages to your policy, or changing name and/or address)

If you have an NCFB Customer Portal Account, log in, click on the Registered Policies tab, then click on the Policy Details link for the desired policy. Click ‘Request a Policy Change,’ or click the Send Email button to generate a message to your agent.

Should I carry comprehensive and collision coverage on my auto policy? If so, how high or low should the deductibles be?

If you have financed or leased a vehicle, you may be required to carry comprehensive and collision coverage. In general, higher deductibles lower your premium but increase your out-of-pocket costs in the event of a loss. Discuss the options that are best for you with your local NC Farm Bureau agent or associate agent.

How long do my points stay on my driving record?

There are two types of driving points: Safe Driver Insurance Points which are chargeable for three years on your insurance policy, and Driver License Points assessed by the North Carolina Division of Motor Vehicles which go against your driving record.

How long am I considered an inexperienced driver?

An inexperienced operator surcharge applies for three years, beginning on the date that the driver received a Level 2 Limited Provisional license. (The surcharge is not applied while the driver has a learner's permit).

What is the difference between a Billing Notice and a declaration?

A Billing Notice is a statement of the amount that you owe to NCFB for charges related to your insurance coverage. A declaration is part of your policy and includes the insured’s name, address, the effective and expiration dates of the policy, a description of what is being insured, the coverage provided under the policy, and the premium charged for the full policy term.

How to Contact Us

How do I contact my agent?

Your agent’s contact information appears in the top right of your policy declaration, and on the billing notices that you receive. If this information is not handy, you can click ‘Find Your Agent’ on the Support page of this website (click on the tab in the top right).

If you are registered on the NCFB Customer Portal, you can contact your agent from there or via the NCFB mobile app.

How do I contact North Carolina Farm Bureau Mutual Insurance Company?

Email: customerservice@ncfbins.com

Telephone: (919) 782-1705 (Monday – Friday, 8:15 AM – 5:00 PM ET)

Mail:

North Carolina Farm Bureau Mutual Insurance Company, Inc.

P.O. Box 27427

Raleigh, NC 27611-7427

Resources & Guides

Articles & Guides

Want more in-depth information on topics like disaster preparedness or signing up for E-Bill?

Insurance Terms

Insurance terminology can seem complicated. This glossary might help you better understand your policy.

Contact Us

Customer Support

Our customer service team is available to answer your questions. Click below to contact us via email, or call us at (919) 782-1705 (M-F, 8:15 am – 5:00 pm, ET)

Email us: customerservice@ncfbins.com

Ask Your Agent

Our agents are always willing to help if you have any questions.

Contact Us By Mail

North Carolina Farm Bureau Insurance Group

P.O. Box 27427

Raleigh, NC 27611-7427